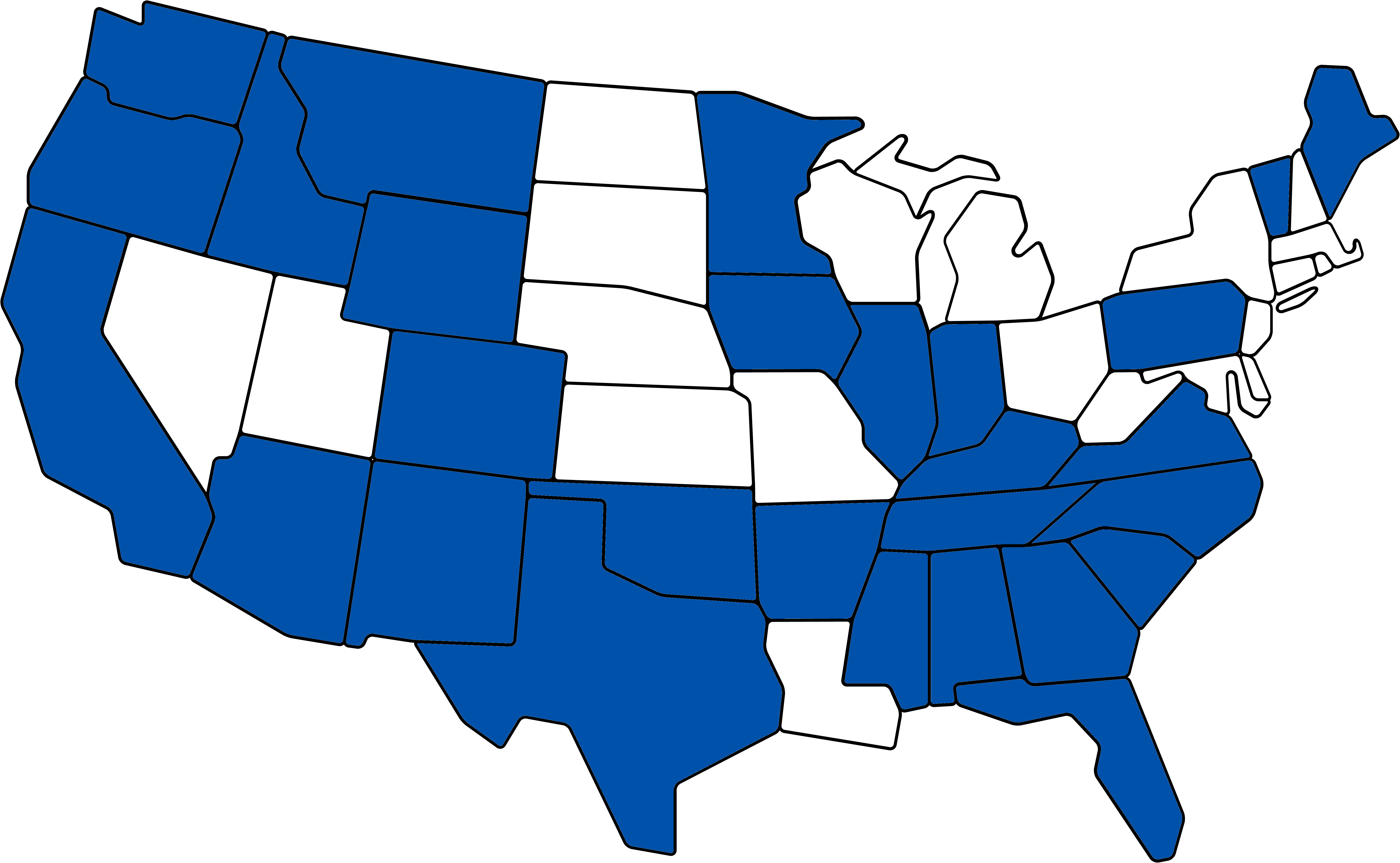

If you’re wondering if can you be a real estate agent and be a licensed loan officer in a specific state, you’ve come to the right place. There are currently 45 states, and Washington, D.C., where you can get be dual licensed as an agent and an MLO. Sheridan Mortgage supports dual licensing in 8 of these states.

For real estate agents, there are a number of benefits to getting licensed as a mortgage originator, including increased commissions and a streamlined client experience.

While deciding to get licensed as a mortgage loan officer can be a valuable way to increase your skill set and offer news services, it’s not possible in every state. Here is a list of states where a real estate agent can also get licensed as a mortgage loan officer:

*States where Sheridan Mortgage supports REA and MLO dual licensing.